October 26, 2004

Cuba's Latest Scheme

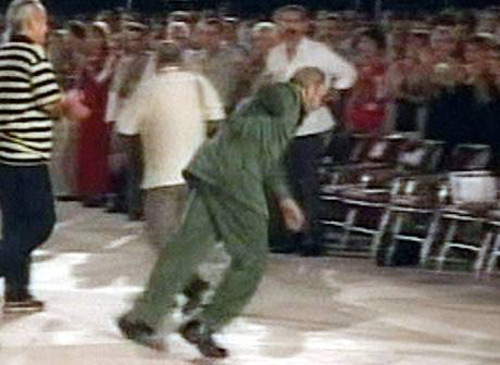

Cuban strongman Fidel Castro took a small step towards a free Cuba last week.

(photo via Val Prieto)

IT SEEMS the Maximum Leader's nasty fall last week has loosened his grasp on economic concepts even further than before. Cuba has announced tonight it will halt use of the imperialist Yankee dollar on the island. The decree goes into effect next month.

The Associated Press reports:

The resolution announced Monday by Cuba's Central Bank seemed aimed at finding new sources for foreign reserves as the U.S. government steps up efforts to prevent dollars from reaching the island as part of a strategy to undermine Fidel Castro's government. Cuba's national currency, the peso, cannot be used with international partners.

"Beginning on November 8, the convertible peso will begin to circulate in substitution of the dollar throughout the national territory," Castro said in a written message read by his chief aide Carlos Valenciaga.

In his message, Castro asked Cubans to tell relatives living abroad to send them money in other foreign currencies, such as euros, British sterling or Swiss francs.

The move was likely to hurt mostly those Cubans who receive American dollars from relatives living in the United States.

Cubans and others on the island can still hold dollars in unlimited quantities and can change them into pesos before the new policy takes effect. But they will have to pay a 10 percent charge to exchange dollars afterward.

"In the short term, there may be a slip in the remittances," said John Kavulich, president of the U.S.-Cuba Trade and Economic Council, which tracks business between the two countries. Some estimates on annual remittances to Cuba are as high as US$1 billion (euro780 million).

"But going into the holidays, people in Miami and New Jersey won't want the holidays for their families on the island to be even more miserable," he said, predicting remittances from those major Cuban American communities would pick up again, despite the difficulty of sending them and the 10 percent charge.

We are amazed Castro's regime thinks this idea is going to work; to our eyes, it seems to play right into the hands of the U.S. Government.

From a regime-survival point of view, we admit the idea looks workable. It will have several short-term positives for the regime:

First. It will force USD-holding Cubans to eventually spend down their dollars should they wish to buy scarce goods (e.g. appliances, cooking oil) from Government-run hard-currency stores. Obviously, these dollars could still be used surreptitiously for payments in the tiny private sector, but sheer necessity will force Cubans to cough them up eventually. Result: Cubans will become more beholden to the regime, which controls the supply of (internally-convertible) Cuban pesos (CUP), the "red won" of Cuba's economy.

Second. The exchange surcharge will effectively devalue the CUP v. the USD, meaning the Cuban regime will steal 10 percent of its citizens' wealth held in dollars. Even worse, if this surcharge goes through, the Cuban government could decide to increase it over time, thus robbing the people of even more wealth. And in theory, the Cubans could seize all the dollars now on the island, giving their holders CUP in exchange. The problem here, of course, is that the non-convertible CUP is one of those currencies that tends to depreciate quickly in an internal market.

Third. The move may cause Cubans abroad to send other hard currencies to the island (EUR, GBP, etc.) in place of dollars. It probably wouldn't be too difficult for Cuba to exchange these currencies for dollars -- or use them in place of dollars -- should the need arise.

However, there is one big flaw in this scheme, and that's in terms of the remittances which Cubans abroad send to the island. The regime clearly hopes that Cubans abroad will send home as many (or more) dollars as they did before its plan goes into effect. But let us say that Cubans abroad, knowing their dollars are being essentially stolen by a regime they hate, decide to reduce their dollar shipments accordingly. They won't cut them off, but where they sent $100 per month before, perhaps they might send $80 -- or $50. And even if they sent the same amount in a different currency, transaction costs involved would cut into those funds. In the end, Cuba could end up with even less in its hard currency reserves than it has now -- and that could cause problems once it runs out of cash.

Of course, the regime's new policy could also cause a lot of more immediate problems, in terms of civil unrest and general unhappiness with the people in charge. That will be of more concern to Castro's followers than to Castro, though -- for they're the ones who will reap the whirlwind when he shuffles off this mortal coil. What a pity the man did not break his neck in that fall, as it would have made things much easier for all concerned!

But the devil will take Castro soon enough; for like any tyrant among men, he knows how to wait.

Posted by Benjamin Kepple at October 26, 2004 12:33 AM | TrackBack